Contribution Per Unit Formula

For the Highest Activity. The company has net sales of 300000.

Contribution Margin Ratio Formula Per Unit Example Calculation

This amount is then used to cover the fixed costs.

. Contribution Margin Ratio 25 50 Contribution Margin Ratio 50 or 050. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. This means Sams team needs to sell 2727 worth of Sams Silly Soda in that month to break even.

Find out the contribution contribution margin per unit and contribution ratio. Combined Profit Volume Ratio can be calculated by using following formula. The contribution margin per shoe is 500000 250000 200000.

The following part of the above formula is for your contribution margin ratio. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. Contribution Margin Per Unit Per Unit Selling Price.

Divide your contribution margin by your sales price per unit. Break-Even Point Units Fixed Costs Revenue per Unit Variable Cost per Unit When determining a break-even point based on sales dollars. The contribution margin in this example would be 14.

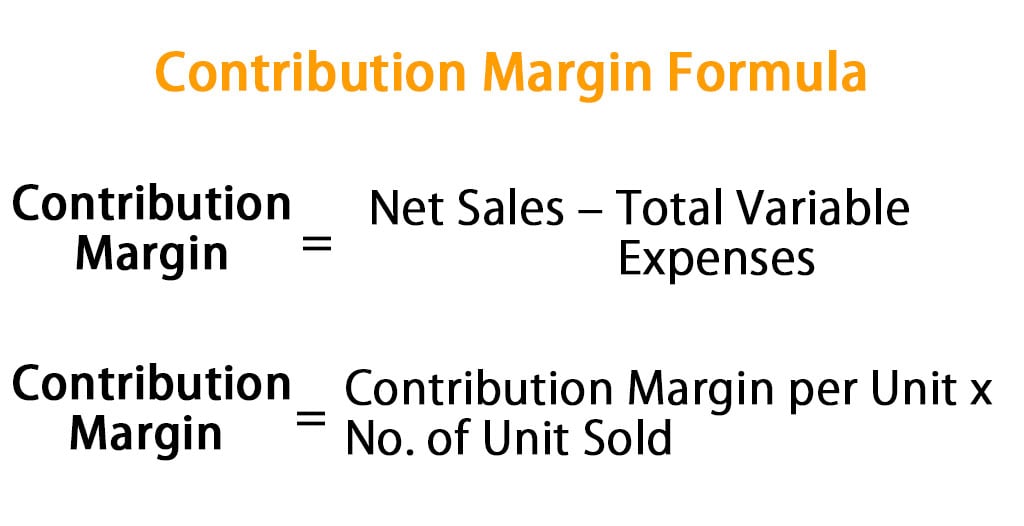

Anything after that amount will be profit for the company. The number of units sold was 50000 units. The contribution margin is determined by subtracting the variable costs from the price of a product.

Fixed Costs Contribution Margin Sales price per unit Variable costs per unit with resulting figure then divided by sales price per unit 200073332727. The formula for contribution margin dollars-per-unit is. The contribution margin ratio is a formula that calculates the percentage of contribution margin fixed expenses or sales minus variable expenses relative to net sales put into percentage terms.

Using the information provided by Eastern Company calculate per unit and total contribution margin of product-X. Total contribution margin Sales revenue Variable expenses 875000. Contribution Margin 20-6.

Fixed costs are 10 million so the company has to sell 500000 units to break even 10 million. Cost Per Unit can be defined as the amount of money spent by the company during a period for producing a single unit of the particular product or the services of the company which considers two factors for its calculation ie variable cost and the fixed cost and this number helps in determining the selling price of the product or services of the company. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.

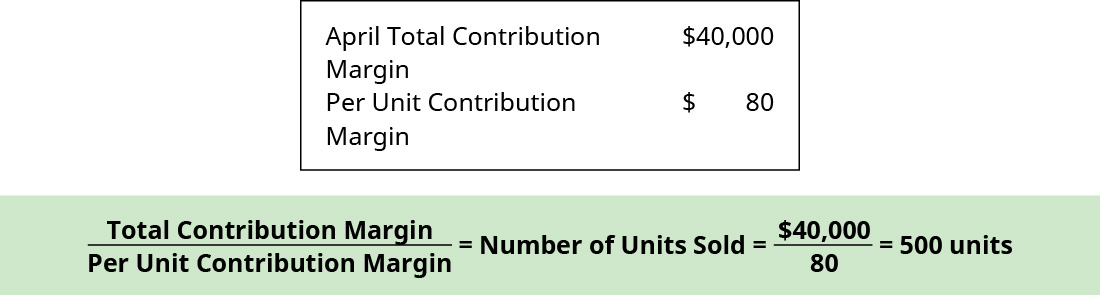

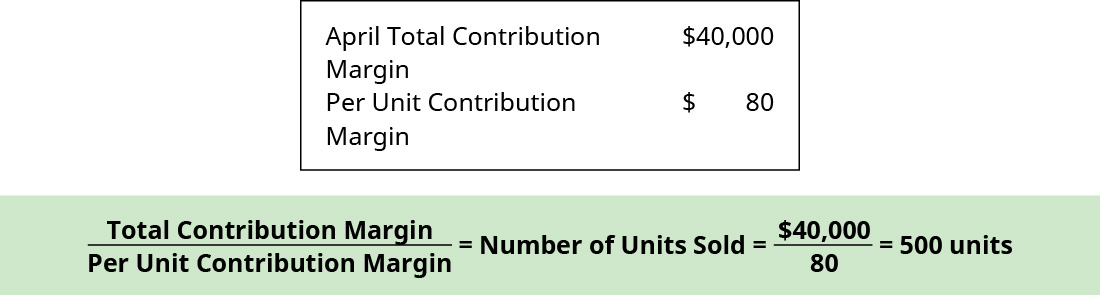

Fixed Cost Highest Activity Cost Variable Cost Per Units Highest Activity Units. Contribution margin per unit formula would be Selling price per unit. Variable Cost Per Unit 3769000 960000 4210 990 Variable Cost Per Unit 87236 per unit.

Contribution represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. Calculation using the mathematical equation is the same as the first calculation of breakeven units that used the contribution margin per unit. Contribution margin per unit Sales price per unit Variable expenses per unit 175 125 50 per unit 100 25.

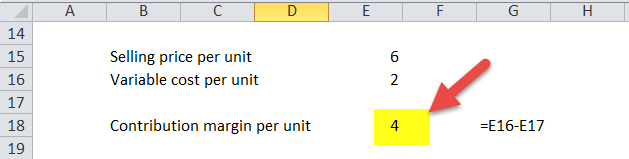

Sales Variable Costs Sales To simplify things lets use the same amounts from the last example. Fixed Cost is calculated using the formula given below. The variable cost per unit is 2 per unit.

That means the CM per unit is 20. Total revenue variable costs of units sold. Here is the formula for contribution margin ratio CM ratio.

Contribution margin CM or dollar contribution per unit is the selling price per unit minus the variable cost per unit. Cost Per Unit Definition. It represents the marginal benefit of producing one more unit.

The last calculation using the mathematical equation is the same as the breakeven sales formula using the fixed costs and the contribution margin ratio previously discussed in this chapter. Unit contribution margin per unit denotes the profit potential of a product or activity from the. The company sells the unit for 20 per unit.

For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. Divide the fixed costs by the contribution margin. We can represent contribution margin in percentage as well.

This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

Contribution Margin Meaning Formula How To Calculate

7 1 Exploring Contribution Margin Financial And Managerial Accounting

No comments for "Contribution Per Unit Formula"

Post a Comment